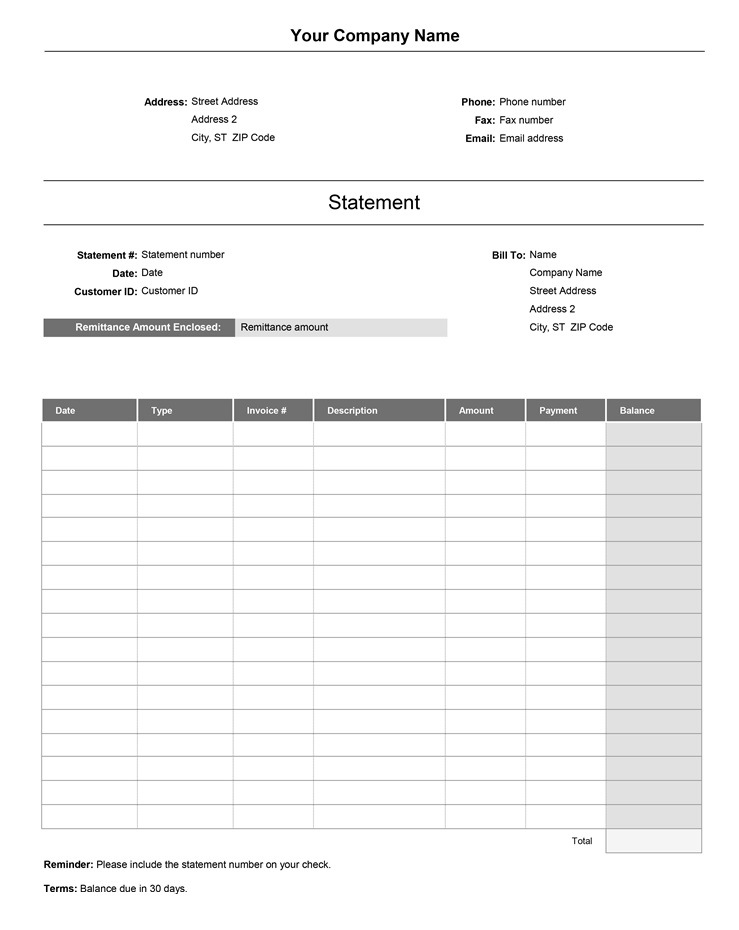

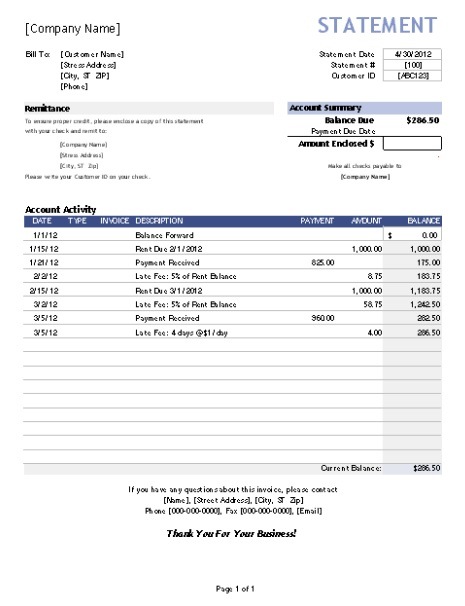

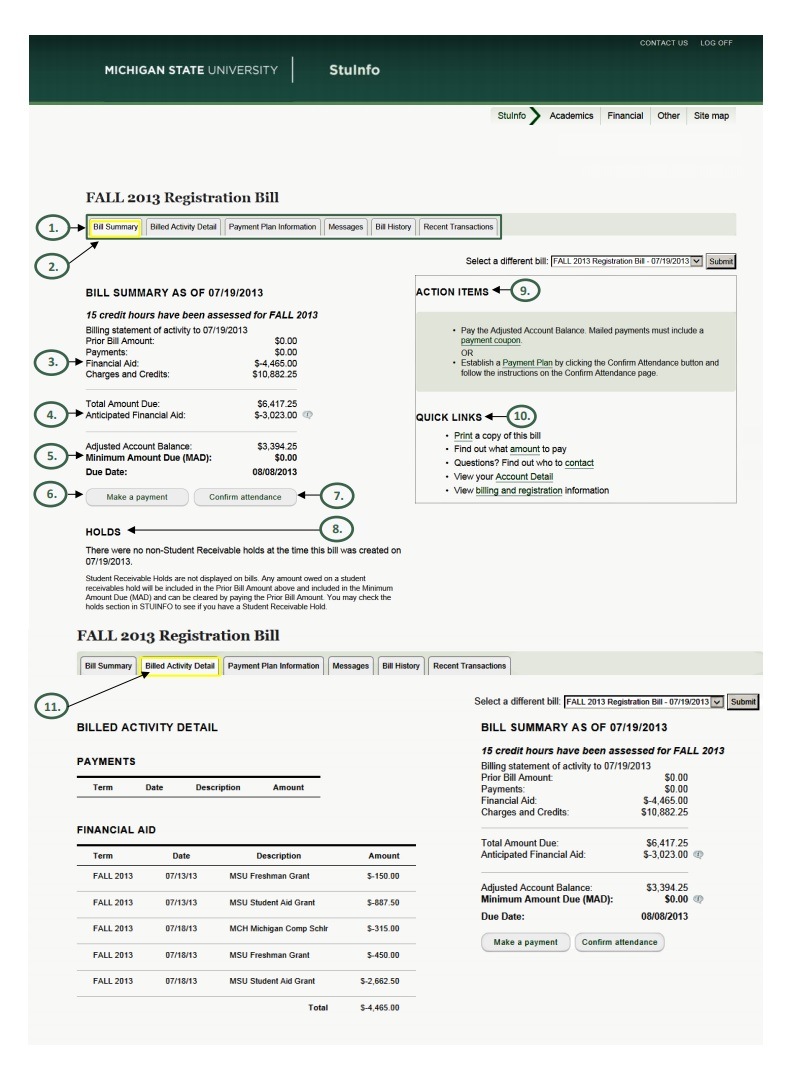

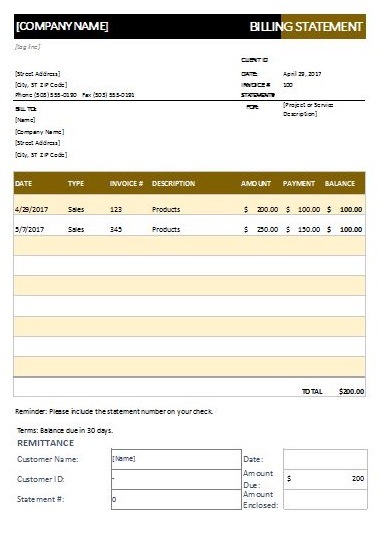

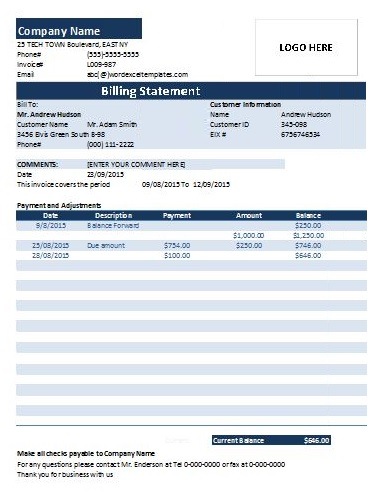

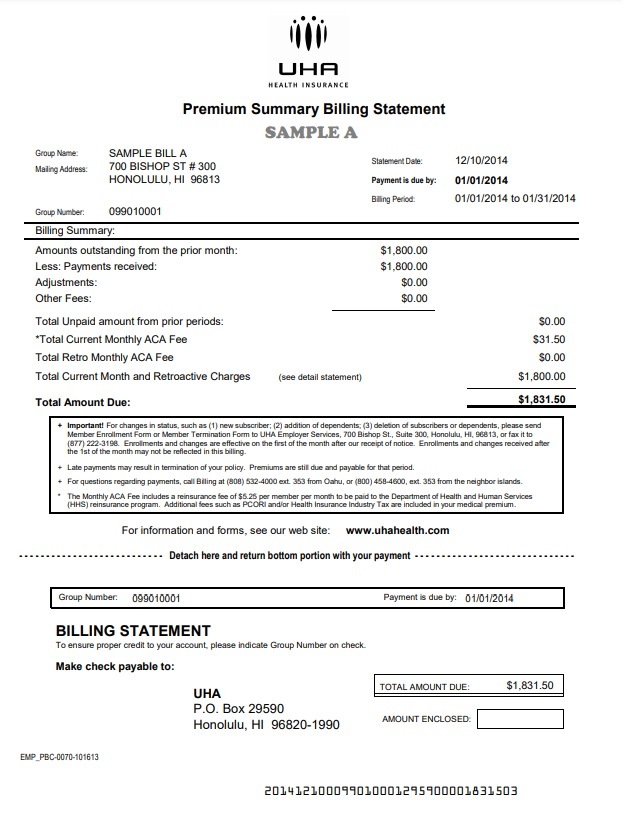

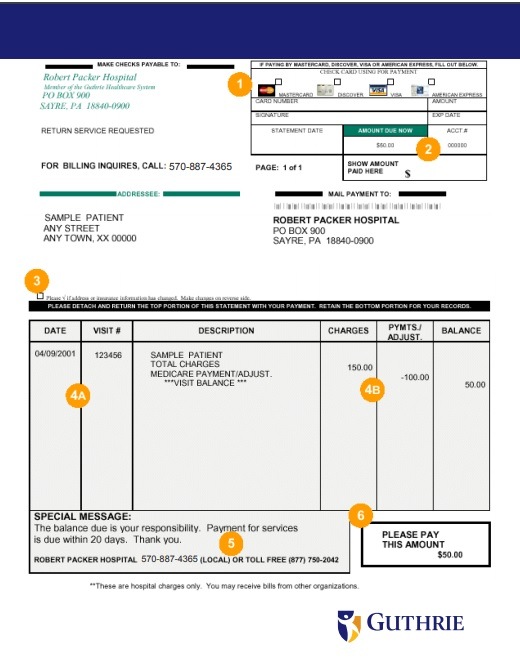

A billing statement template is a formal weekly or monthly report that is generated by financial companies or banks for various reasons. Usually, they send back these statements to their clients to inform them about the transactions that took place during a certain time period. Every credit facility is accompanied by separate bill statements. For instance, credit facilities like short-term loans, credit cards, cash lines and personal loans have separate billing formats. A billing statement template often consists of multiple segments that enable facility holders to know crucial information. For instance, minimum payment required, actual credit balance, premium amount charged on transactions, remaining credit limit and transaction details.

Billing Statement Reporting:

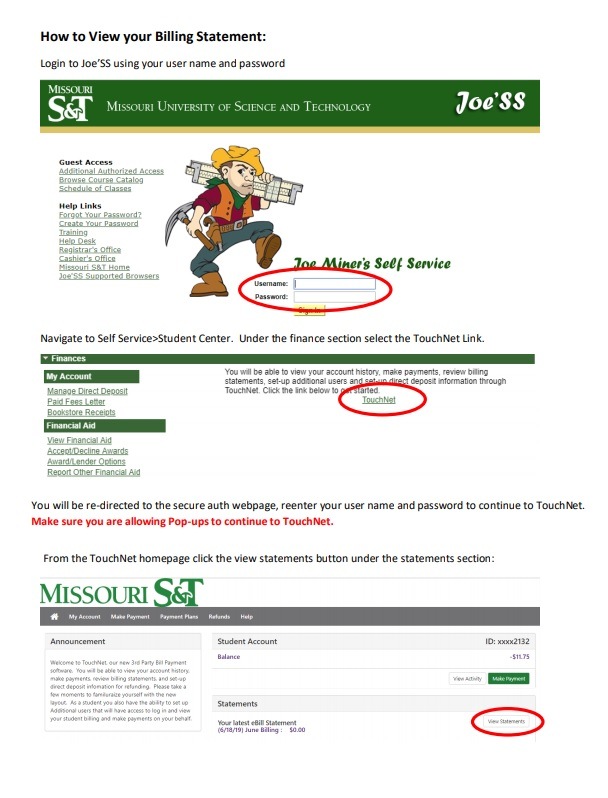

Clients can ask for multiple options for the facility, especially related to reporting, such as monthly reporting, weekly reporting, transaction alert reporting and low balance reporting. Further to this context, the client can click on the option of receiving it on email or physical address.

Billing Statement Information:

No doubt a billing statement is a periodic statement which keeps a record of purchases listing the method of payments made by credit/debit cards within the billing cycle of account. These monthly bills are sent by the credit card companies to the midst of customers to insure the activities of their ongoing and outstanding purchases they have freely made within the limit of their bank account. Moreover, these financial institutes issue this statement as a summary of the activities of their accounts.

Billing Statement Details:

As we discussed above, this statement is further divided into different segments which are important and crucial for the client. It starts with previous balance, previous bonus points, installment amount, cash advance fee charged, balance transferred, remaining interest charged and merchant refund or pending claim information which is provided in this report. Moving further, it covers the minimum amount due segment where the user can understand how much he or she needs to pay. It may include any installment amount plus previous interest amount which was pending or any claimed which is now due. This minimum amount is necessary to pay in order to continue enjoying the credit facility.

The next segment is about basic information about the account, such as; total credit limit award, total used credit limit, available limit for the next period, cash advance limit, payment cycle, last date of minimum payment, printing date and special note about the account. It also includes award points which the user has earned the previous month, total points till date, bonus points added to balance and reward points which have been redeemed previously.