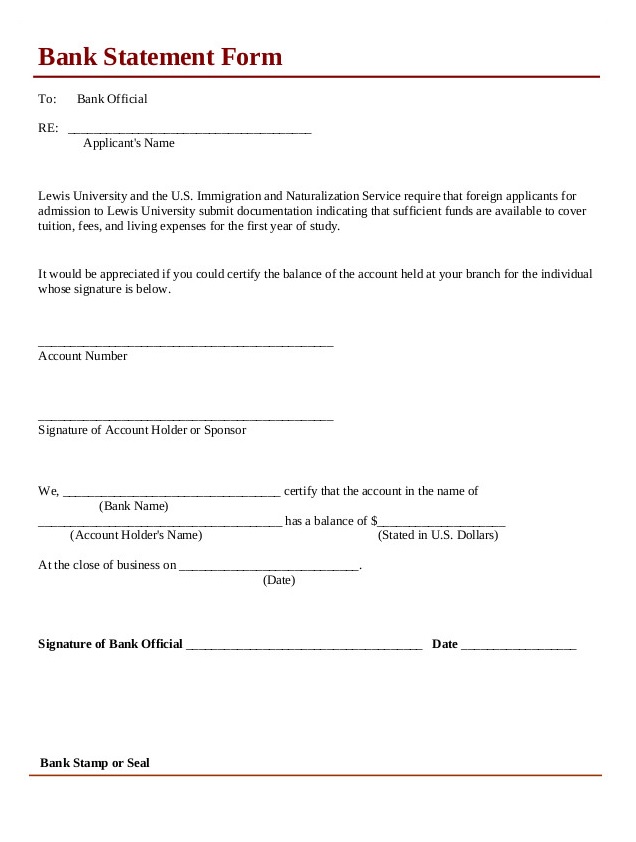

A bank statement template is a professional statement which can be defined as a legal report owned and released by an authorized bank’s financial officer or authority. It is issued at the written request of the account holder. Without the request, a bank is supposed to issue this statement periodically as per the given manual, under the governance of federal authorities. Generally, there are certain laws which bind a financial institution or a bank to issuing periodic account statements to each account holder. This period varies from region to region depending on a country’s financial emergency or state ordinance. Usually, a bank issues a statement of account to each account holder every quarter, six-months or yearly either through e-mails or by post. With the help of mobile applications, now account holders can view their account statements more frequently and easily. Furthermore, these bank statements are computer-generated statements and do not require authorization. Similarly, if authentication is required, then the official staff of the bank will sign it with a stamp.

What is the purpose of a bank statement?

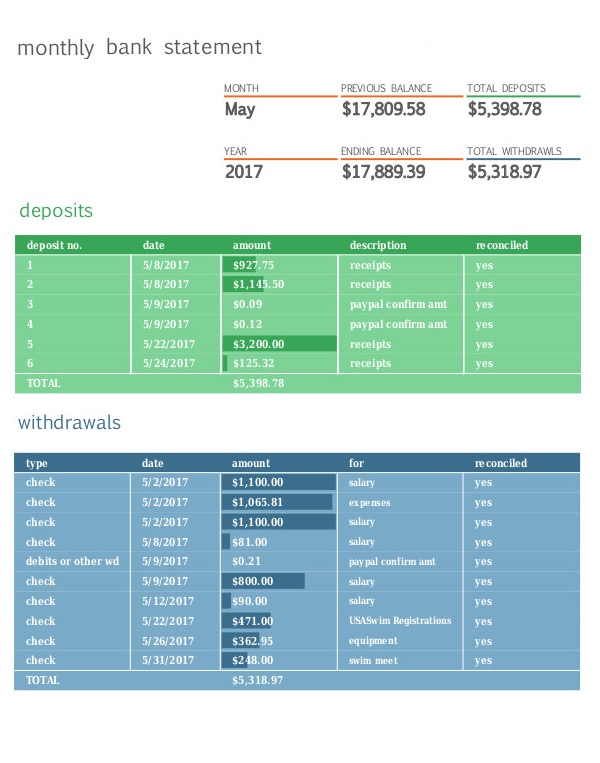

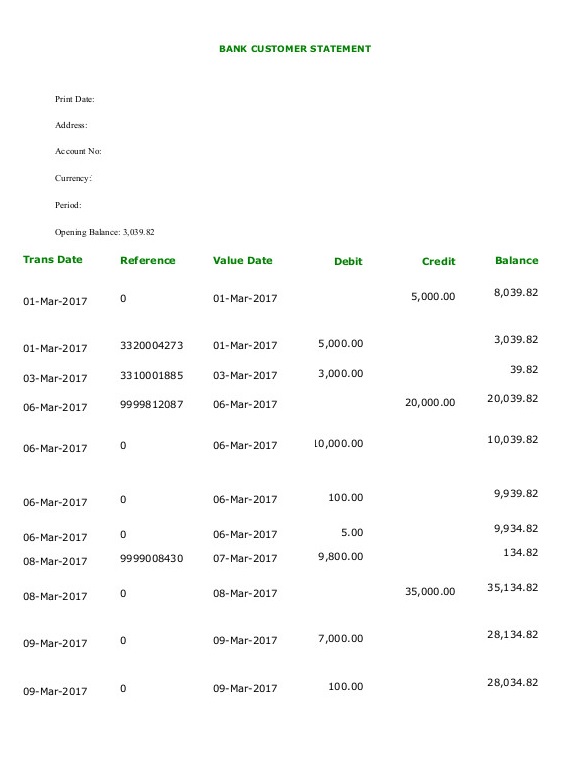

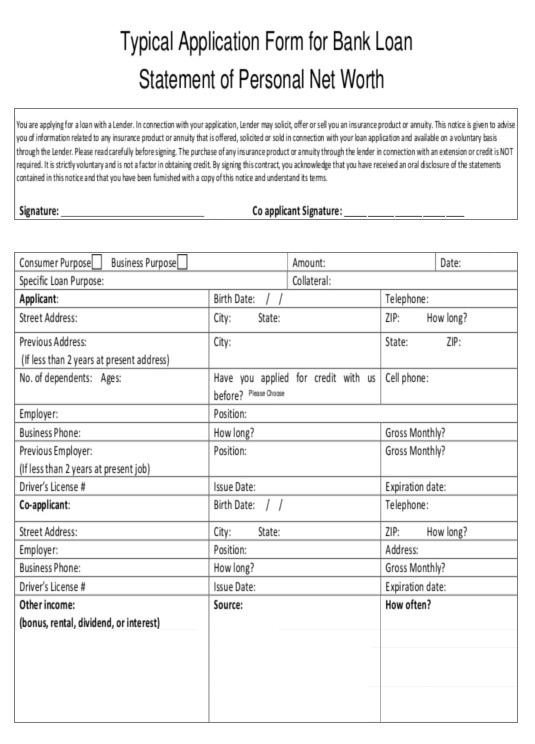

The purpose of issuing or sending a bank statement to account holders is simply to inform them about the current cash balance and transactions which took place during a specific period of time. As we know that these debit or credit transactions reflect a positive or negative impact on the cash balance. Moreover, the closing balance of this statement means an account holder still has cash available which he or she can withdraw. There are certain facilities which banks offer to their account holders to withdraw more than available balance. This facility is called overdraft in account or credit limit in liability asset. The cash amount withdrawn under this facility will be charged with interest depending on the current interest rate. Moving further, a bank statement clearly reflects the opening balance as well as the closing balance during the specific period for which this statement is generated. Remember that not every account holder is entitled to an overdraft or credit line facility. There are a set of rules which need to follow in order to authorize someone for such a facility.

What is the importance of a bank statement?

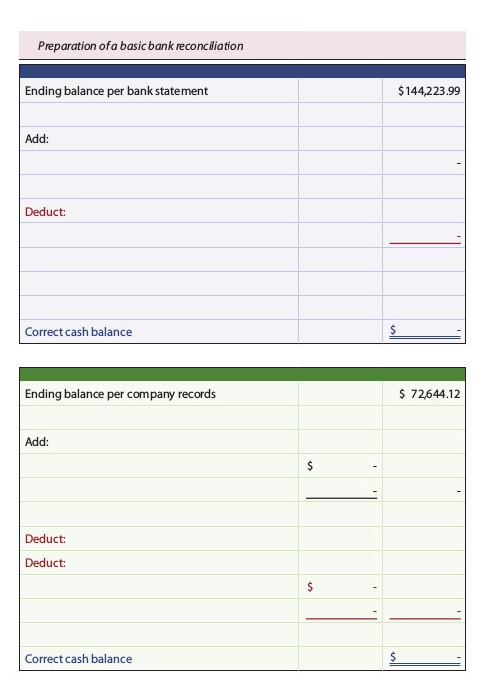

As far as the importance of a bank statement is concerned, we can say that it holds great importance. Normally, it is an official way to provide a record of your checkbook’s transactions that occurred during a specific period. If an account holder agrees with the bank statement, then he or she can keep it as a record of your account. Otherwise, the account holder can contact the bank for further information or rectifications. For this purpose, the account holder can bring his or her own created statement for rectification. Generally, this statement is known as a cash reconciliation statement and when it is accepted by bank and corrected, it is called a bank reconciliation form or statement. Once all entries are rectified or cleared, the bank re-issues a bank statement.

Usage of a bank statement:

As discussed above, a bank statement is a record of all cash transactions made by both the account holder and the bank during a specific period. However, this statement is also noted as a definite or clear expression of balance and activities related to debit or credit transactions within the account. Moreover, it is a detailed summary of financial transactions which is entirely compiled by a banking system to show the account holder with lists of deposits along with all the common but crucial information. For instance, withdrawals, check lists, paid checks, bounced checks, interest rate, amount of interest on transactions, earned interest, service charges, details for penalties and even more. Nonetheless, a bank statement will also serve as an up-to-date report of existing account balance along with incurred transactions values as well.

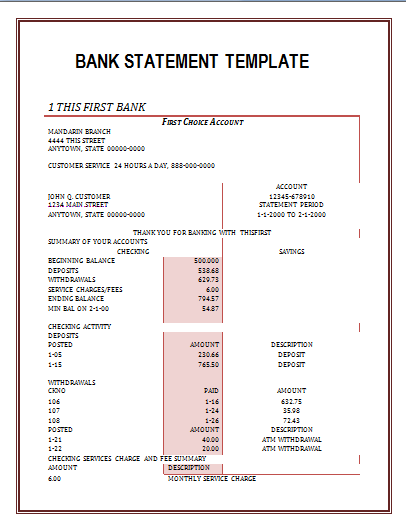

Details of a bank statement template:

The basic use of bank statements can be defined as an example here. For instance, bank statements may help the account holders to prevent themselves from overdrafts. For this purpose, they can keep an eye on transitions and closing balance. A professional bank statement assists them to catch bank errors as and when a statement is issued. Moreover, these are fairly simple components and can be useful for summarizing the details of all the transactions, account the credit details. It is the duty of bank to provide a complete and accurate statement in accordance with the current value of the account, showing accurate and true information of every new activity, and highlighting deposits and withdrawals on specific dates.