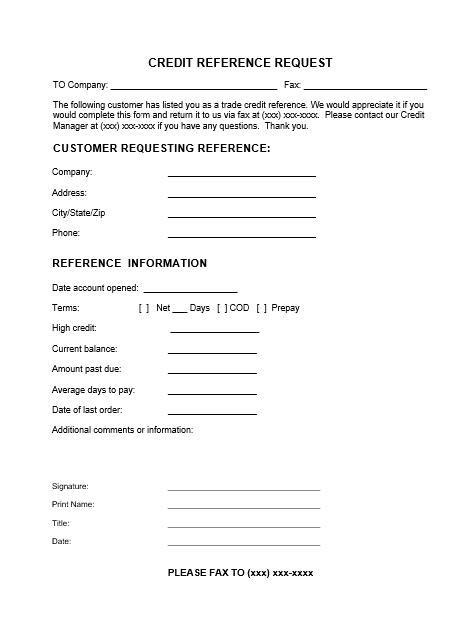

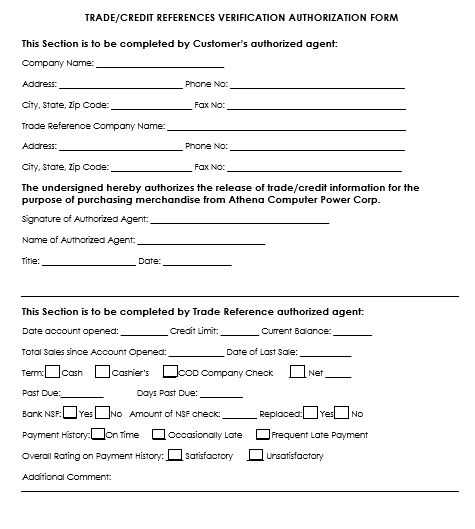

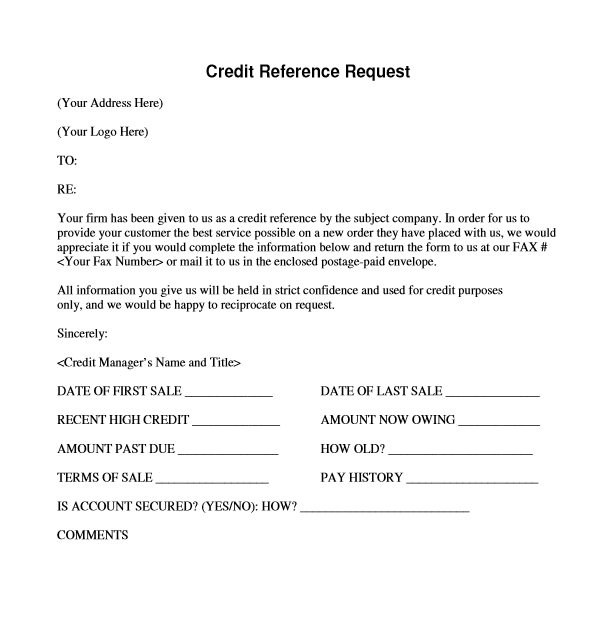

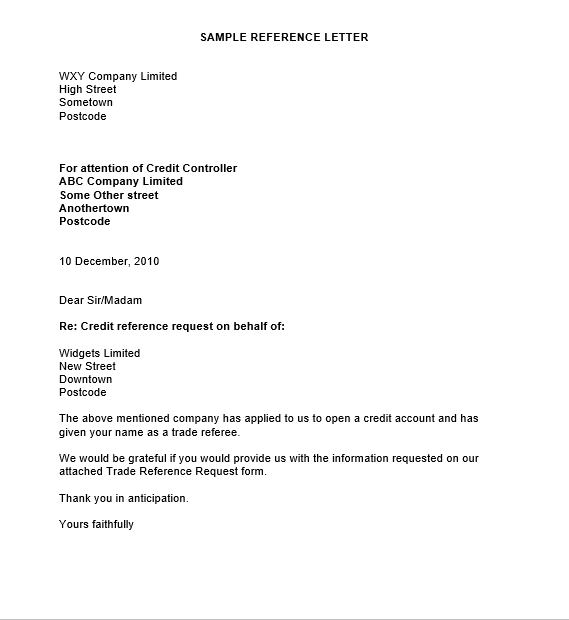

A credit reference template is a general report from the credit agency for either a business or an individual that affirms the creditworthiness and dignity of the forthcoming borrower. It is also known as credit status or credit report. Generally, the document includes the name of the individual or the name of the agency that gives the information about an individual’s previous credit history and statistics. A credit reference report is used to provide detailed information about an individual’s or an organization’s capacity to repay their financial commitments or loan. These references are very useful for banks and financial organizations because they ascertain the creditworthiness of an individual or a business. Moving further, these reports help you to identify how much loan amount you can borrow at what rate. This way, it makes it easy for you to manage your cash flows without delaying installment amounts or loan repayments.

Benefits of Using a Credit Reference Sheet:

The sample credit reference format gives many benefits to its users. This is because borrowing any amount at any level is a risky transaction and requires completing certain file work before disbursement. The credit history of an individual describes tendency, behavior and will to pay dues on due dates. Moreover, it consists of your payment history, relationship life, and what products or services you purchased or acquired. If you have a history of making late payments, then this statement will highlight these issues with a maximum delay period in the past 12 months or 24 months. Usually, financial analysts use this document before evaluating the creditworthiness of any individual or a business. Therefore, a credit reference sheet holds more importance than credit or confidential reports. Some of the major advantages of using an accurate credit reference template are given below:

1. Reputation collateral.

2. Business growth.

3. Improved margins.

4. Increased customer loyalty.

5. Fewer defaulters.

6. It helps in improved revenue collection.

Importance of a Credit Reference statement:

Free credit reference templates are considered crucial documents that are used for the purpose of credit management. These templates will assist you with repaying the loan amount without disturbing working capital requirements or commitments. This document ensures the availability of funds which a business or individual needs to pay at the agreed time and date. That is the reason why it has a strong impact on a business credit management plans or strategies. Generally, the banks and other financial institutions use this report to decide whether to approve a credit line proposal or not. Being a significant document for lenders, it alarms red flags and highlights them with red light or ink. This way, it enables the lender to study the credit reference report and decide what risk elements need to be mitigated with what strategies. As far as different types of credit reference reports are concerned, there are as follows: credit report, asset documentation, financier support and personal character reference. Moving forwards, these credit reference templates are designed for your assistance and all you need to do is to download these perfect formats.